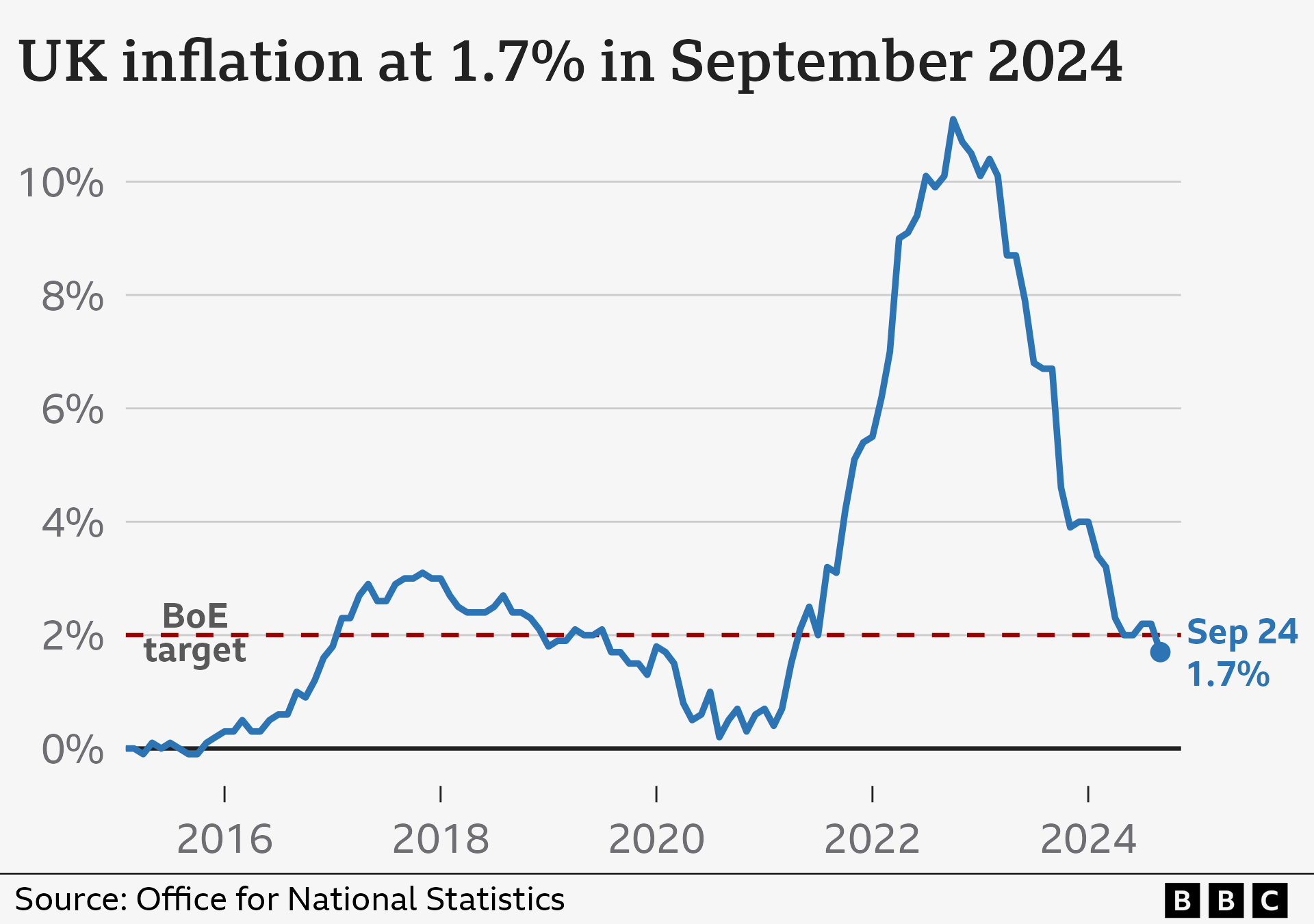

Prices in the UK went up by 1.7% in the 12 months to September, the lowest rate in three-and-a-half years.

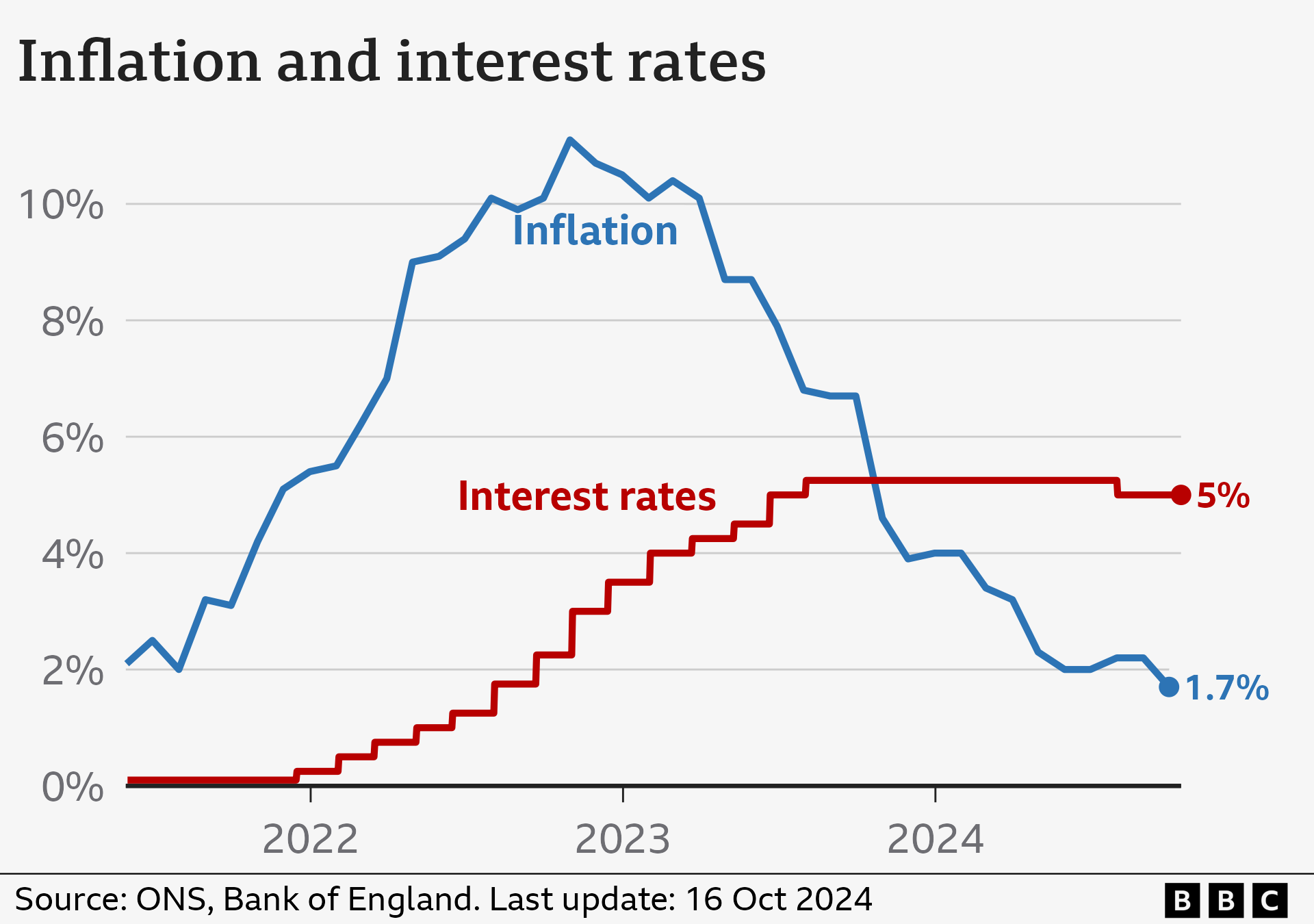

The Bank of England has a target to keep inflation at 2%, and puts interest rates up and down to try to meet it.

What does inflation mean?

Inflation is the increase in the price of something over time.

For example, if a bottle of milk costs £1 but is £1.05 a year later, then annual milk inflation is 5%.

How is the UK's inflation rate measured?

The prices of hundreds of everyday items, including food and fuel, are tracked by the Office for National Statistics (ONS).

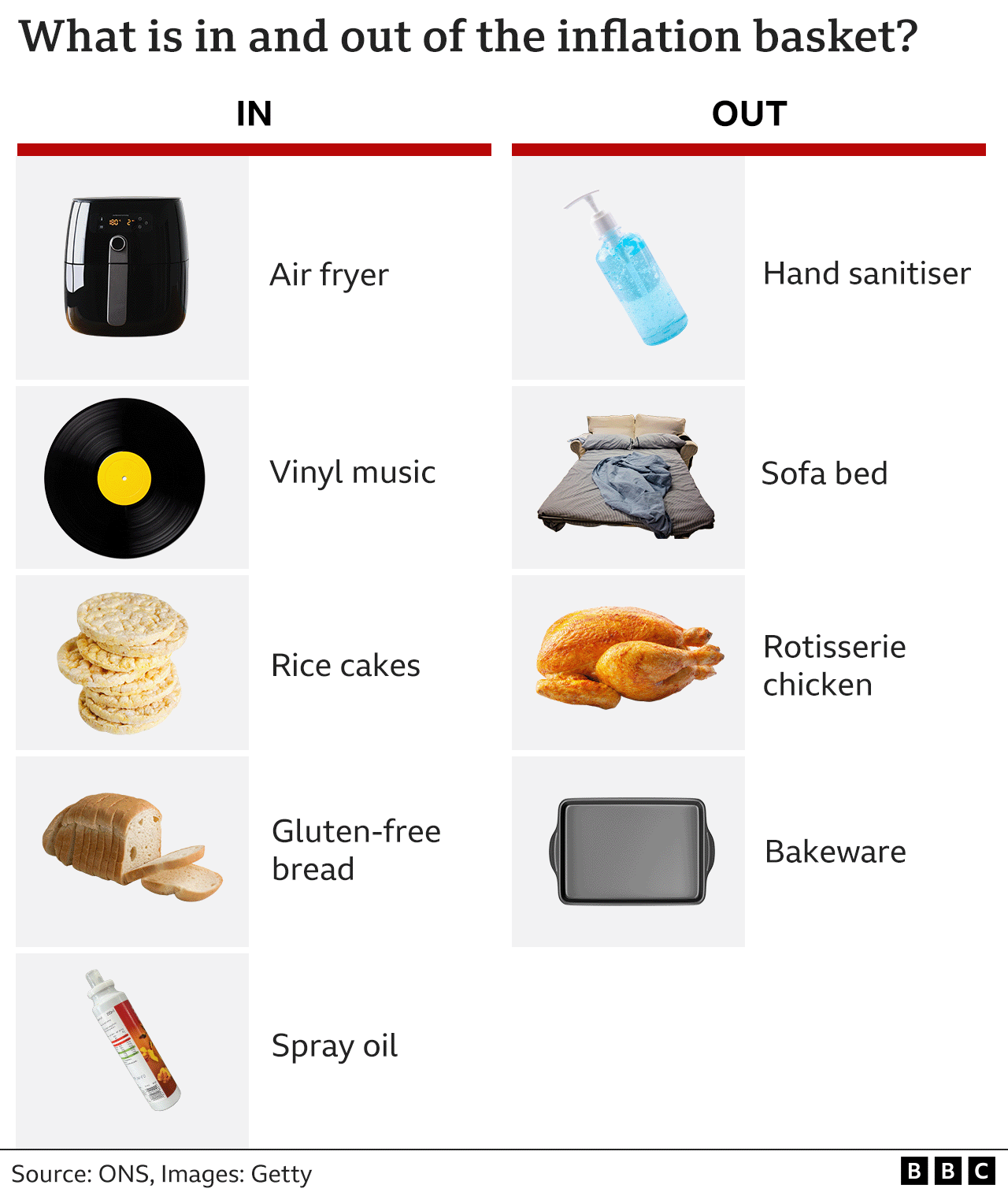

This virtual "basket of goods" is regularly updated to reflect shopping trends, with vinyl records and air fryers added in 2024, and hand sanitiser removed.

The ONS monitors price changes over the previous 12 months to calculate inflation.

The main inflation measure is called the Consumer Prices Index (CPI).

The latest figures show that CPI rose by 1.7% in the year to September, down from2.2% in the 12 months to August.

Analysis had expected inflation to drop to 1.9%, but lower airfares and petrol prices meant it fell further.

The September CPI figure of 1.7% is used to decide how much many benefit payments will go up in April 2025.

This includes all the main disability benefits.

However, the state pension is set to rise by 4%, under an arrangement called the triple lock.

Why are prices still rising?

Inflation has fallen significantly since it hit 11.1% in October 2022, which was the highest rate for 40 years.

However, that doesn't mean prices are falling - just that they are rising less quickly.

Inflation soared in 2022 because oil and gas were in greater demand after the Covid pandemic, and energy prices surged again when Russia invaded Ukraine.

It then remained above the Bank of England's 2% target partly because of high food prices.

Although these have now dropped back, some parts of the economy, like the services sector - which includes everything from restaurants to hairdressers - are still seeing more significant price rises.

Why does putting up interest rates help to lower inflation?

The Bank of England uses interest rates to try and keep inflation at 2%.

When inflation was well above that target, it increased interest rates to 5.25%, a 16-year high.

The idea is that if you make borrowing more expensive, people have less money to spend. People may also be encouraged to save more.

In turn, this reduces demand for goods and slows price rises.

But it is a balancing act - increasing borrowing costs risks harming the economy.

For example, homeowners face higher mortgage repayments, which can outweigh better savings deals.

Businesses also borrow less, making them less likely to create jobs. Some may cut staff and reduce investment.

What is happening to UK interest rates?

The Bank of England cut rates to 5% in August, the first fall for four years, and held them at that level in September.

At the time of the August cut, the Bank of England governor Andrew Bailey said cooling inflation pressure meant the bank should be able to cut interest rates gradually over the upcoming months.

But he added: "It's vital that inflation stays low, so we need to be careful not to cut too fast or by too much."

Although the headline CPI figureof 1.7% is below the 2% target, the Bank also considers other measures of inflation, such as "core inflation", when deciding how to change rates.

Core inflation doesn't include food or energy prices because they tend to be very volatile so can be a better indication of longer term trends.It was 3.2% in the year to September, down from 3.6%.

In its latest forecast for the global economy, the International Monetary Fund (IMF) warned that persistent inflation in countries including the UK and US might mean interest rates have to stay "higher for even longer".

But in October, Mr Bailey said the Bank of England could be a "bit more aggressive" at cutting borrowing costs, if inflation remained under control.

A further interest rate cut is widely expected at the Bank's next meeting on 7 November.

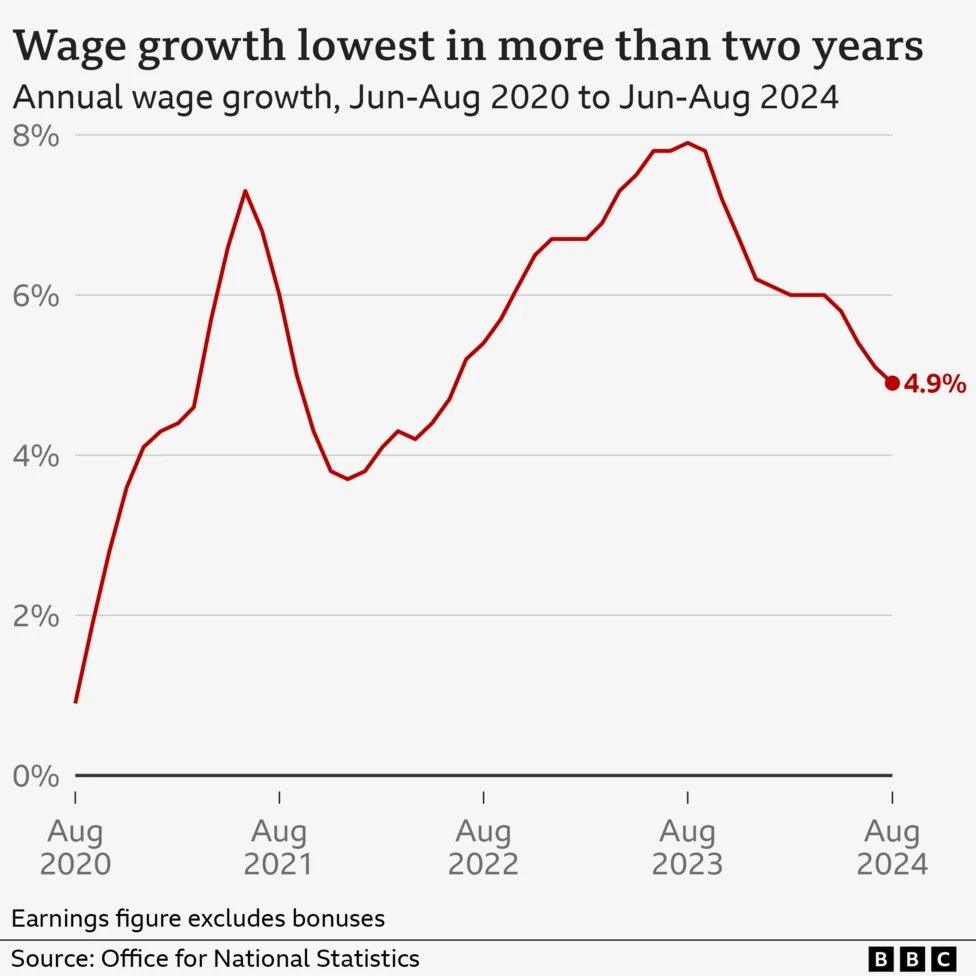

Are wages keeping up with inflation?

The latest official quarterly figures show that pay grew at its slowest rate for more than two years between June and August.

Average annual growth in pay (excluding bonuses) during the three-month period was 4.9%, down from 5.1% in the previous quarter.

Despite the slowdown, wages are still rising faster than inflation.

What is happening to inflation and interest rates in Europe and the US?

Many other countries have also seen the past few years' higher inflation and interest rates fall back.

The inflation rate for countries using the euro was 1.8% in September, down from 2.2% in August and 2.6% in July.

In June, the European Central Bank (ECB) cut its main interest rate from an all-time high of 4% to 3.75%, the first fall in five years.

It cut rates again to 3.5% in September.

US inflation fell to 2.4% in September, down from 2.5% in August and 2.9% in July. This is the lowest rate since February 2021.

At its September meeting, the US central bank lowered rates for the first time in four years, cutting its key lending rate by 0.5 percentage points to between 4.75% and 5%.

The cut was larger than many analysts had predicted, and the bank's forecast signalled that rates could fall by another half percentage point by the end of 2024.

.png)

Post a Comment