White men from higher socio-economic backgrounds are 30 times more likely to succeed in financial services than working class ethnic minority women, a study has found.

The Bridge Group carried out the research for Progress Together examining the career progression of almost 150,000 people across the sector.

Chief executive of Progress Together Sophie Hulm said: "Socioeconomic background has the greatest impact on career progression."

Businesses could soon be forced to collect and report their diversity and inclusion data under proposals by the Financial Conduct Authority (FCA) to improve diversity in the sector.

"But if you lay on top ethnicity and gender, there is even more disadvantage," she added.

At grassroots level, efforts are being made to tackle these barriers.

Andrien Meyers is Anglo-Indian and Gavin Lewis is black.

They noticed each other at a conference in 2010 as they were the only two people who were not white in the room.

They began talking about how they could make change - 10 years later, the Catalyst Education Programme was born.

Andrien, an independent councillor for City of London Corporation, said: "We've been in the industry for more than a decade, and we're not seeing enough diverse individuals come through."

He says bringing in people from different backgrounds improves decision making and is good for business.

"Having a diverse pool of talent around the table helps, make better decisions."

He hopes that bringing more people in at a lower level will help progress careers "all the way up to the executive suite".

Anoushka is 17.

She has a place on the Catalyst Education programme.

She says when she goes in to a firm and sees people that look like her helped to inspire her.

"Some firms mention diversity and inclusion as an important factor but I don't see it, it seems that something they are just saying but I don't see it being reflected.

"Hopefully we will change that in a few years' time and the industry will be diverse."

Maria, 17, also attends the after school sessions on the programme.

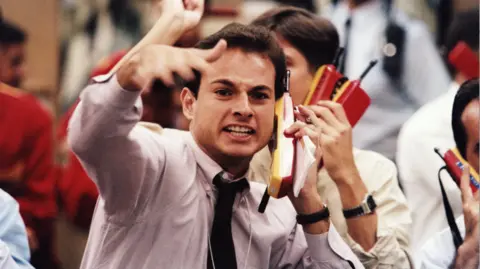

She said: "Generally when you think of finance, you think of white men."

She says working with other young people from a similar background "stops me from being deterred from going into finance".

bbc

bbcAahil, another student on the programme said there was an "iron wall" for some people with backgrounds like his.

He said: "There's so much jargon and it's so hard to get in to the industry because there's so much nepotism within the financial industry."

He said the after-school sessions learning about bonds and other ways of working in the city helped to level the playing field - exactly what its founders hoped for.

Getty Images

Getty ImagesBut while many acknowledge the good things happening to open up the city, it's not necessarily travelling up to board level.

The Progress Together also found that women from working class backgrounds have a significant "double disadvantage", progressing 21% more slowly than their peers from more advantaged families.

Dr Louise Ashley is the author of Highly Discriminating: Why the City Isn't Fair and Diversity Doesn't Work and is senior lecturer at Queen Mary University of London.

She believes businesses want to improve diversity, and many firms were getting better at attracting diverse talent at entry level.

But she also believes there can be pressure for individuals to conform to an environment where people have to act a certain way which can be "psychologically exhausting".

She said: "In the city, you can be different as long as you're more or less the same and I think that many people coming in to the city are having to manage that paradox every single day."

She says this can stunt progression for individuals.

Co-founder of the Catalyst Education Programme, Gavin Lewis grew up on a North London council estate.

He now holds a top city job.

He says the industry needs to understand and embrace that people from non-traditional backgrounds come with "a different perspective and a different outlook".

He says making the young people see themselves in the industry is important.

"Aspiration is the key thing.

"Many (young people) won't even know or appreciate that they could not only get into the industry but thrive in the industry, but I do think the industry also needs to create an environment where they can thrive."

The financial services watchdog, the FCA, is consulting on plans to make it mandatory for companies to collect and report diversity and inclusion data.

It said: "Greater diversity and inclusion can create better outcomes for consumers and markets by supporting healthy work cultures, reducing groupthink, unlocking talent and improving understanding of diverse consumer needs."

It is proposing to introduce voluntary data reporting on socio-economic background as a first step, rather than making this a requirement.

Sophie Hulm believes this is a "missed opportunity" as companies will miss the full picture.

The FCA consultation ends on Monday.

Post a Comment