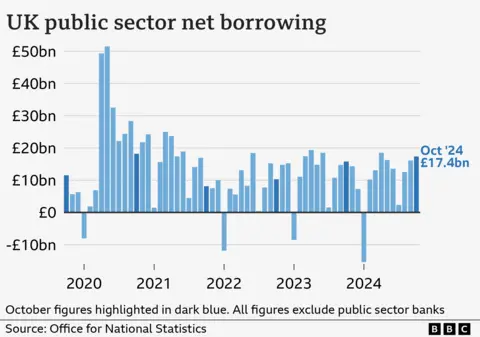

Government borrowing was much higher than expected in October, as debt interest payments hit a record high for the month and public sector pay rises contributed to higher spending.

Borrowing - the difference between spending and tax take - stood at £17.4bn last month, the second highest October figure since monthly records began in 1993.

The borrowing figures are the first to be released since Chancellor Rachel Reeves' first Budget last month, which outlined higher spending and increased taxes.

However, analysts said the worse-than-expected borrowing figure underlined the difficulties the chancellor faced in keeping public finances under control.

The borrowing figures are the latest piece of challenging data for the government.

Inflation figures released on Wednesday showed prices rising faster than expected, while last week it emerged that the economy barely grew between July and September.

In addition, the chancellor has come under pressure from businesses and the farming community to reverse some of the tax increases announced in the Budget.

Questions have also been raised over Reeves' CV, following claims she had embellished some of her past achievements.

The Office for National Statistics (ONS), which produced the figures, said government revenue had risen last month, despite the cut in National Insurance rates earlier in 2024.

"However, with spending on public services, benefits and debt interest costs all up on last year, expenditure rose faster than revenue overall," said Jessica Barnaby of the ONS.

Interest payments on government debt hit £9.1bn last month, the highest October figure since monthly records began in 1997.

The ONS figures also showed government spending on pay was up £2.2bn from a year earlier, reflecting some of the impact of the latest public sector pay deals.

When Labour came to power it announced above-inflation backdated pay increases for NHS staff and teachers, and these came into effect in October.

Borrowing in the financial year to October has now reached £96.6bn, the ONS said, which is £1.1bn more than at the same point last year.

Chief Secretary to the Treasury Darren Jones said Labour had inherited a difficult economic situation following the election, and the Budget was aimed at "fixing the foundations and putting public finances on a sustainable footing".

"This government will never play fast and loose with the public finances. Our new robust fiscal rules will deliver stability by getting debt down while prioritising investment to deliver growth."

Shadow chancellor Mel Stride said the scale of borrowing last month was "a direct result of Labour’s decision to hand out inflation busting pay rises to their union paymasters without any reforms in return".

Alex Kerr, UK economist at Capital Economics, said October's "disappointing" borrowing figures demonstrated "the fiscal challenge that the chancellor still faces", with Reeves having "little wiggle room".

"While the chancellor has downplayed the chances of further tax-raising measures, if she wants to increase day-to-day spending in future years, she may need to raise taxes to pay for it," he said, referring to the chancellor's self-imposed targets.

Last month's Budget is set to increase government spending by almost £70bn a year over the next five years, according to the Office for Budget Responsibility, with half funded through higher taxes and the rest coming through higher borrowing.

The ONS said that net debt - the total amount of money owed by the government that has built up over years - had reached £2.8 trillion.

This amount is 97.5% of the size of the UK's economy as measured by gross domestic product (GDP), and remains at levels last seen in the early 1960s.

At the Budget, Reeves changed the government's public finance rules, which will see it track a wider measure of debt to give it more scope to borrow for investment.

This new measure of debt - public sector net financial liabilities (PSNFL) - was at 83.7% of GDP in October, the ONS said.

The government is aiming to have this measure of debt falling as a share of the economy by the 2029-30 financial year.

Sign up for our Politics Essential newsletter to read top political analysis, gain insight from across the UK and stay up to speed with the big moments. It’ll be delivered straight to your inbox every weekday.

Post a Comment