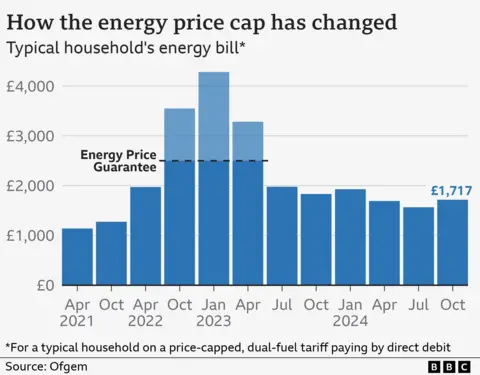

Another rise in gas and electricity bills could be confirmed on Friday, when energy regulator Ofgem announces the price cap for January.

Billpayers are encouraged to submit a meter reading when prices change to ensure they are charged the correct amount.

What is the energy price cap and how is it changing?

The energy price cap covers 28 million households in England, Wales and Scotland and is set every three months by Ofgem.

It fixes the maximum price that can be charged for each unit of energy on a standard - or default - tariff for a typical dual-fuel household which pays by direct debit.

Between 1 October and 31 December, gas prices are capped at 6.24p per kilowatt hour (kWh), and electricity at 24.50p per kWh.

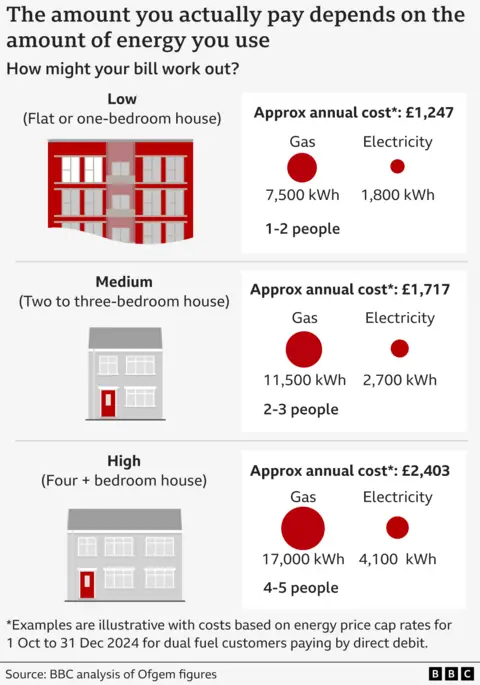

This means the annual bill for a dual-fuel direct debit household using a typical amount of energy is £1,717 per year, an increase of £149 from the previous cap.

Those who pay their bills every three months by cash or cheque pay £1,829.

Analysts at forecaster Cornwall Insight, which tracks the energy market, thinks prices for the January to March period could rise by 1%. That would mean a typical bill would be £1,736 a year.

It does not expect prices to fall substantially in the foreseeable future.

The cap does not apply in Northern Ireland, which has its own energy market.

What is a typical household?

Your energy bill depends on the overall amount of gas and electricity you use, and how you pay for it.

The type of property you live in, how energy efficient it is, and how many people live there, all make a difference.

The Ofgem cap is based on a "typical household" using 11,500 kWh of gas and 2,700 kWh of electricity a year with a single bill for gas and electricity, which they settle by direct debit.

The vast majority of people pay their bill this way to help spread payments across the year. Those who pay every three months by cash and cheque are charged more.

Why should I take a meter reading?

Submitting a meter reading when the energy cap changes means you won't be charged for estimated usage at the wrong rate.

This is especially important when prices go up.

Customers with working smart meters do not need to submit a reading.

Can I fix my energy tariff?

Fixed-priced deals offer certainty for a set period - often a year, or longer - but, if prices drop, people could find themselves stuck at a higher price.

Ofgem says customers should consider fixed deals as an option, especially if they want the security of a set price.

However, it recommends getting independent advice.

The price comparison site Uswitch says it's important to check whether fixed deals have exit fees before signing up and to make sure you fully understand the terms of the contract.

Because the price cap changes every three months, it is difficult to know with any certainty whether a fixed tariff is a good deal. The longer the fixed term, the greater the uncertainty.

What is happening to prepayment customers?

Between October and December, households on prepayment meters are paying slightly less than those on direct debit, with a typical bill of £1,669, a rise of £147 from the previous quarter.

About four million households had prepayment meters in April 2024, according to Ofgem.

Many have been in place for years, but some were installed more recently after customers struggled to pay higher bills.

New rules mean suppliers must give customers more opportunity to clear their debts before switching them to a meter. They cannot be installed at all in certain households.

Getty Images

Getty ImagesWhat are standing charges and how are they changing?

Standing charges are a fixed daily amount to cover the costs of connecting to a supply.

They are typically 61p a day for electricity and 32p a day for gas, although they vary by region.

Campaigners argue the charges are unfair because they make up a larger part of the bill of low energy users.

Ofgem has outlined options to change standing charges and asked energy suppliers, consumer groups and household bill payers to give their views. This consultation closed on 20 September.

Separately, the regulator is adding £28 to everyone's bill between April 2024 and March 2025 to cover the cost of dealing with £3.1bn of debt that customers owe to suppliers.

What is happening to the winter fuel payment?

Changes to the winter fuel payment mean more than 10 million pensioners will not receive the money this winter.

Previously, it was paid to all pensioners in England and Wales born before 25 September 1957.

But in July, the government said future payments would be made only to those on low incomes who received certain benefits, including pension credit.

The 2024 payment - worth £200 or £300 depending on individual circumstances - is being paid automatically to eligible pensioners in November or December. Hundreds of thousands of eligible people do not claim pension credit.

What other help can I get with energy bills?

The £500m Household Support Fund, which was introduced in September 2021 to help vulnerable customers, had been due to end in autumn 2024.

However, Work and Pensions Secretary Liz Kendall has extended this until March 2025.

The Warm Home Discount scheme continues to offer a discount to eligible pensioners and low income households.

The government's Fuel Direct Scheme can help people to repay an energy debt directly from their benefit payments.

In addition, suppliers must offer customers affordable payment plans or repayment holidays if they are struggling with bills.

Most suppliers also offer hardship grants.

Post a Comment